The Gap: What’s In Store For Investment Opportunity?

/After writing about the investment opportunity in McDonalds, I received a lot of feedback from Charisse Says members to continue to share my thoughts, and its implications for everyday people (like you and me), on other opportunities. Well…

Ever since The Gap announced that it was laying off 500 corporate workers late last month, the company has caught my attention. The Gap, which owns accessible Gap, higher-end Banana Republic, discount-oriented Old Navy, and athleisure-focused Athleta brands, is feeling the pain of changing consumer tastes, inflation, and a change in direction.

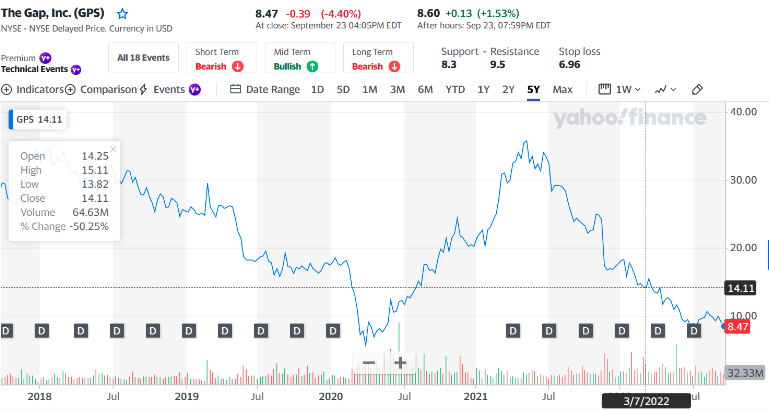

The Gap’s stock (TICKER: GPS) began to tumble significantly in August after Gap announced a cut to its fiscal first-quarter revenue forecast due to increasing discounts. The stock has recently been trading under $10, down from just over $35 in May - wow, right??

Today, sales and profitability are suffering; Bob Martin, Gap’s executive chairman and interim CEO said quite bluntly that “We’ve let our operating costs increase at a faster rate than our sales, and in turn our profitability.” Here are a myriad of other factors that have plagued the company recently, as laid out in TheStreet’s Gap Lays Off 500 as Fast-Fashion-Focused Consumers Snub Its Brands:

Struggle to lure consumers to what at one time was an enviable balance of low-, medium-, and high-end offerings - fickle customers

Fierce competition from fast-fashion clothing lines like H&M, Zara, and Shein

Still-low mall foot traffic

Rising labor and other costs

Challenging logistics

Problems at its Old Navy chain, which now constitutes over 50% of sales

End of its 10-year partnership with Ye (formerly Kanye West)

I have to admit, I have enjoyed Gap clothing at certain times during my life - for myself in the 90s, and over the past few years as a parent, aunt, and godmother as I buy discounted clothing there for the little people in my life. I was a Banana Republic fan in the 2000s as I started my career on Wall Street, and depending on what I might need spur-of-the-moment, you might find me buying clothes from Old Navy. Personally, I feel that I do not get the same (or better) quality from Gap brands as I did in the past. From the problems at Gap, I suspect that I am not alone.

So, I wonder if you feel as if the Gap’s stock is a buying opportunity or whether you wouldn’t touch the stock with a 10-foot pool. As a point of reference, here is the stock chart over the last 5 years:

Here’s what I ask you to consider while the stock is trading at a “presumably” cheap price:

Do you believe that The Gap can turn itself around, amidst a transition in leadership?

Do you think that The Gap is poised to improve its sales and profitability, which will drive earnings higher?

Do you feel moved to buy The Gap brand clothing for yourself and/or others?

If you do buy the company, at what price would you be willing to sell the company?

Let’s be real - the market is down all around. And, it’s up to you and me to make sense of whether there are strong investment opportunities in our midst. Maybe the Gap is one of them for you, or not?

A Wealthy Girl Corner

As you know and laid out in my book, A Wealthy Girl: 7 Steps to Prosperity, Peace, and Personal Power, I believe that the traditional wealth equation of assets minus liabilities is inherently flawed because our country has historically (and even today) made it nearly constitutionally, legally, and socially impossible for groups - especially Black and Brown folks - to generate traditionally wealth.

Before investing in a stock to generate wealth for yourself, I also want you to ask the question - is the CEO of that firm an anti-racist? In September, Ellen McGirt of Fortune in her article, “Is Your CEO an anti-racist,” shared my thoughts on this very topic. I do believe that CEOs who do not strive toward anti-racism can have a destructive wealth effect, and I question how associated you want to be with such companies. Since the article may be behind a pay-wall for you, here are my major points:

“The problem is, everyone is staying in the ‘diversity, equity, and inclusion’ bucket,” says Charisse Conanan Johnson, managing partner of Next Street. “What we need to be talking about is anti-racism.”

“I don’t think there is a shared guiding light… a common language in the journey to becoming an anti-racist organization,” she says. Senior leaders need to be trained in that language and given the tools to interrogate their internal policies and practices. And then they need to do it.

“Government, corporate, philanthropy—everyone needs to work in concert with each other,” she says. “Be bold enough to make the right changes internally and have the right leaders that really embrace that inward introspection and interrogation and want to do something.”