Pop Goes the SNAP!

I hope this Wednesday afternoon finds you well. I had plenty of “Oh Snap” moments over the last week, and here’s the top 3:

- The NEXT LEVEL: How to Make Money in the Stock Market class is almost sold-out and there’s only 1 seat left – you can claim it HERE now

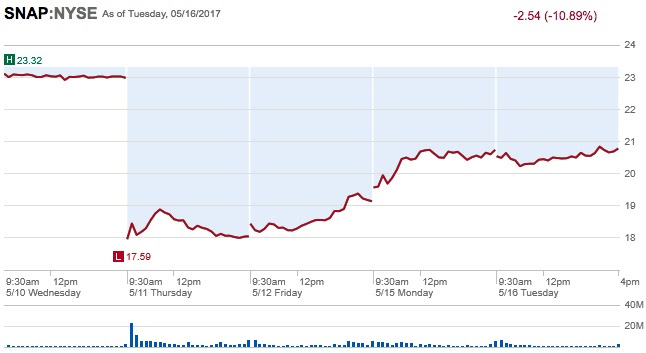

- SNAP, the parent company for social media app Snapchat, had its first earnings announcement since its IPO in March – a complete disaster as the stock took a nose dive, although it has rebounded over the week

- Your ability to deduct mortgage interest deduction on your taxes is whetted to our country’s current wealth divide – A recent NYTimes article, “How Homeownership Became the Engine of American Inequality,” is fascinating and real

Your NEXT LEVEL seat – only 1 Left

I am waiting for YOU to take the leap of faith and there’s one lucky seat waiting for you. Tired of working hard and still feeling like you can’t get ahead with your money? Well, this class will help you learn to make your money work for you in the stock market. I extended the final deadline a few hours until 9pm CST tonight so that you have some time to sign-up after you get home from work. If you missed it last week, I also now allowed a monthly payment plan. If you have any last questions, please let me know. One enrolled student has already expressed her expectation on how the class will help her:

“I see this class a way to empower myself as work with my financial advisor so that I am more knowledgeable about my money and where it’s going.” Claim the last spot now HERE.

SNAP took a nose dive

One of the cardinal rules for companies that IPO is this - set reasonable expectations for the investment community. And by reasonable, I mean expectations that you can beat with no problem. SNAP did the opposite. When the company released earnings last week, revenue and user growth fell short of expectations. As a result, the stock tanked. If you need a refresher on how earnings announcements affect stock prices, please see my video on why they matter. At the same time, SNAP’s CEO took home a $750 million dollar bonus for taking the company public – think about that one.

That said, its stock has rebounded nicely (as of yesterday’s close) and gained back almost half of the value that it lost a week ago. See the chart below. Are you still interested in the stock? What's changed?

The Inequity of Mortgage Interest Deduction

The Inequity of Mortgage Interest Deduction

The NYTimes article, “How Homeownership Became the Engine of American Inequality,” is probably one of the best I’ve read in laying out the history behind this tax benefit, and its effect on the wealth divide. One of the major takeaways is that the mortgage interest deduction has been a main vehicle to help people grow their wealth over time. I have personally benefited from deducting mortgage interest on my taxes as it has effectively provided more money back into my pocket. That said, what are we doing to provide any relief for rent-burdened individuals? Feel free let me know your thoughts.